If you’ve been tracking your portfolio lately, you’ve probably noticed that the investment landscape in 2026 feels like a high-speed chase. Between the relentless surge of AI-driven stocks and the volatility in the Indian IT sector, choosing where to park your hard-earned money has never been more critical.

The age-old debate—Index Funds vs. Active Mutual Funds—has reached a fever pitch this year. As India’s Mutual Fund industry crosses a staggering ₹81 lakh crore in AUM, investors are asking: should I stick to the steady, low-cost path of an index fund, or is it finally time to let a professional manager try to beat the market?

In this guide, we’re going to look past the marketing fluff and dive into the actual performance data of 2026 to see which fund type truly deserves a spot in your SIP.

What Exactly are We Comparing?

Before we talk numbers, let’s refresh the basics. While both are “pooled” investments, they operate with completely different philosophies:

Active Mutual Funds: These are the “proactive” players. A fund manager uses research, economic data, and a bit of gut instinct to pick specific stocks. Their goal? To beat a benchmark (like the Nifty 50 or Sensex).

Index Funds (Passive): These are the “copycats.” They don’t try to be clever. Instead, they simply mirror an existing index. If the Nifty 50 goes up 10%, the index fund goes up 10% (minus a tiny fee).

In 2026, the distinction has become even sharper as Passive Funds now account for nearly 19% of the total industry assets, up significantly from just a few years ago.

Performance Reality Check: 2026 Edition

So, who is winning the race this year? The answer depends entirely on where you are looking in the market.

1. The Large-Cap Struggle

In the world of “Giant” companies (the Large-Caps), 2026 has been a tough year for active managers. Since these stocks are so heavily analyzed, it’s incredibly difficult for a human to find a “hidden gem” that the rest of the market hasn’t already spotted.

The Verdict: Index funds tracking the Nifty 50 or Sensex have consistently matched or outperformed about 75% of active large-cap funds this year. When you factor in the much lower expense ratios, the “passive” route is winning the large-cap battle.

2. Mid-Cap and Small-Cap Magic

This is where the story changes. 2026 has seen massive “valuation pressure” in smaller companies. However, skilled fund managers have been able to navigate this by avoiding the “landmines” and picking high-growth winners.

The Verdict: In the mid-cap and small-cap segments, active mutual funds are still showing their worth. Many top-tier active funds have outperformed their benchmarks by 3-5% this year, justifying their higher fees for investors with a stomach for volatility.

3. The “IT Crash” of 2026

One of the biggest stories of early 2026 has been the “relentless selling” in the IT sector, with giants like TCS and Wipro seeing significant pullbacks.

Active Advantage: Active managers were able to “slash stakes” in IT stocks early in the year, protecting their investors from the full brunt of the crash.

Index Disadvantage: If you held a Nifty 50 Index Fund, you had no choice but to ride the IT sector down, as those stocks are permanent fixtures in the index.

Benefits: Why Choose One Over the Other?

Why Index Funds?

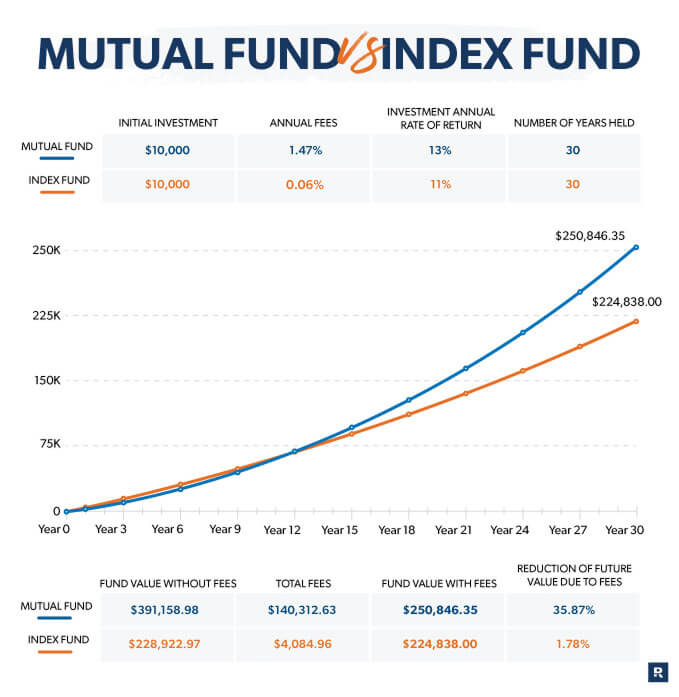

Low Expense Ratios: You aren’t paying for a fancy office or a “star” manager. In 2026, some index funds have expense ratios as low as 0.1%, compared to 1.5% or more for active funds.

No “Manager Risk”: You don’t have to worry about your fund manager having a bad year or leaving for another company.

Transparency: You know exactly what you own at all times.

Why Active Mutual Funds?

Downside Protection: As we saw with the IT sector this year, a human can move to cash or defensive stocks during a crash.

Beating the Average: If you pick a top-performing manager, your returns can significantly outpace the general market.

Targeted Growth: Active funds can lean into specific themes—like Green Energy or Defense Manufacturing—that might not be well-represented in a broad index.

The 2026 Challenges: What to Watch Out For

Investing in 2026 isn’t without its hurdles. Whether you go active or passive, keep an eye on these:

Tracking Error: For index fund fans, always check the “tracking error.” This is the difference between the index’s return and the fund’s return. In a volatile 2026, some funds are struggling to stay perfectly in sync.

The “Best Fund” Myth: Beware of “Top 10 Funds for 2026” lists. Past performance is a poor predictor of the future. A fund that soared in 2025 might be the one that crashes this year because it’s “overvalued.”

Taxation Shifts: Remember that in 2026, the tax rules on capital gains are strictly enforced. Long-term gains (over 12 months) above ₹1.25 lakh are taxed at 12.5%, making “buy and hold” strategies more valuable than ever.

Future Trends: What’s Next for 2027 and Beyond?

As we look toward the horizon, the line between these two fund types is blurring:

Smart Beta Funds: These are “hybrid” funds that track an index but use a set of rules (like “only buy low-volatility stocks”) to try and beat it. Expect these to explode in popularity in 2027.

AI-Managed Active Funds: We are seeing the first mutual funds where the “manager” is actually a proprietary AI system, capable of processing millions of data points a second.

The Shift to Direct: More investors are moving to Direct Plans (which have no distributor commissions), with nearly 49% of all assets now sitting in direct schemes as of early 2026.

Conclusion: Which One Wins for You?

In the 2026 showdown, there is no single “winner”—only the right tool for your specific goals.

Go with Index Funds if you want a “set it and forget it” strategy for your core large-cap savings. They are cheap, efficient, and beat most pros over the long haul.

Go with Active Mutual Funds for the “spicier” parts of your portfolio, like mid-caps or sectoral plays where a human expert can still find an edge.

The best strategy for 2026? A Hybrid Approach. Use a low-cost index fund for 60% of your portfolio and pick 2-3 high-quality active funds for the remaining 40%. That way, you get the best of both worlds: stability and the chance for “outperformance.”

No Responses