Let’s be honest: nobody likes seeing a huge chunk of their hard-earned salary vanish into the “Tax” column of their payslip. As we move into 2026, tax planning has become more than just a year-end chore—it’s a survival skill for your bank account. With the New Tax Act 2025 now fully in effect as of April 1, 2026, the landscape has shifted significantly. While the New Tax Regime has become the default for many, for those who choose to stick with the Old Tax Regime, Section 80C remains the “OG” of tax-saving. It allows you to deduct up to ₹1.5 Lakh from your taxable income, potentially saving you over ₹45,000 depending on your bracket.

But where should you actually put your money this year? Whether you’re a conservative saver or a risk-taking wealth builder, this comprehensive guide breaks down the absolute best Section 80C investment options in India for 2026. Let’s get your taxes down and your net worth up!

Understanding Section 80C in the 2026 Landscape

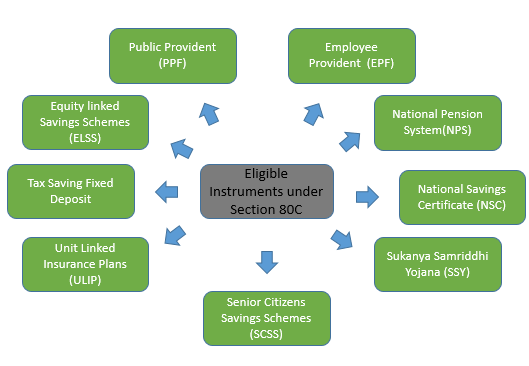

Section 80C is essentially a “reward” from the government for being a disciplined saver. By investing in specific financial instruments, you reduce the income on which you are taxed. This section has been the cornerstone of Indian middle-class savings for decades.

The Math is Simple:

If your annual income is ₹12 Lakh and you invest ₹1.5 Lakh in 80C options, the government only taxes you on ₹10.5 Lakh.

The 2026 Reality Check:

The New Tax Regime (now the default) offers lower rates and a higher tax-free limit, but it does not allow 80C deductions. You must explicitly opt for the Old Regime to claim these benefits. Always use an official Income Tax Calculator to see which path saves you more!

The Heavy Hitters: Best 80C Investment Options for 2026

1. Equity Linked Savings Scheme (ELSS) – The Growth Engine

If you want your money to beat inflation and don’t mind a bit of market “spice,” ELSS is the undisputed king. These are mutual funds that invest at least 80% of their assets in equity and equity-related instruments.

Lock-in Period: Only 3 years (the shortest in the 80C family!).

Returns: Market-linked. Historically, top-performing ELSS funds have delivered 12-15% over the long term.

Taxation: As per the 2026 rules, Long-Term Capital Gains (LTCG) above ₹1.25 Lakh are taxed at 12.5%.

Best For: Young professionals and those with a higher risk appetite looking for long-term wealth creation.

2. Public Provident Fund (PPF) – The Safety Net

PPF is the “Old Reliable.” It’s a government-backed scheme, meaning your money is 100% safe from market volatility. It follows the legendary EEE (Exempt-Exempt-Exempt) status—no tax on the investment, the interest earned, or the final maturity amount.

Lock-in Period: 15 years (long-term commitment).

Returns: Currently around 7.1% (revised quarterly by the government).

Risk: Zero.

Best For: Conservative investors building a corpus for a child’s education, marriage, or their own retirement safety net.

3. National Pension System (NPS) – The Retirement Specialist

NPS is a unique hybrid tool. While you can use it for your ₹1.5 Lakh 80C limit (under Section 80CCD(1)), it has a secret weapon: an extra ₹50,000 deduction under Section 80CCD(1B). That’s a total of ₹2 Lakh in tax savings!

Returns: Varies (typically 8-12%) based on your chosen allocation between Equity (E), Corporate Debt (C), and Government Bonds (G).

Lock-in: Your funds are locked until you turn 60.

Best For: Individuals looking for a structured retirement plan with an additional tax “kicker.”

4. Sukanya Samriddhi Yojana (SSY) – Empowering the Girl Child

If you are a parent to a daughter below the age of 10, this is arguably the best fixed-income instrument in India. It usually offers a significantly higher interest rate than PPF and also enjoys EEE tax status.

Current Rate: Around 8.2%.

Lock-in: Until the girl child turns 21 (partial withdrawal allowed for higher education after she turns 18).

Best For: Parents wanting a safe, high-yield dedicated fund for their daughter’s future.

5. Employee Provident Fund (EPF) & VPF

For salaried employees, your 12% contribution to EPF is automatically counted toward your ₹1.5 Lakh 80C limit. If you have “room” left in your 80C bucket, you can increase your contribution through the Voluntary Provident Fund (VPF).

Current Rate: Around 8.25%.

Risk: Low.

Best For: Salaried folks who prefer a “set it and forget it” deduction directly from their paycheck.

The 80C Hidden Gems: Expenses You Didn’t Know Counted

Did you know that Section 80C isn’t just about investments? You can also claim deductions for certain mandatory life expenses:

Children’s Tuition Fees: Fees paid to any school, college, or university in India for up to two children are eligible.

Home Loan Principal Repayment: While the interest is claimed under Section 24, the principal part of your EMI falls under 80C.

Life Insurance Premiums: Premiums for yourself, your spouse, or your children (up to 10% of the sum assured) are deductible.

Stamp Duty & Registration: The costs incurred during the purchase of a new house can be claimed in the year they are paid!

Comparison: Which One Fits Your Life?

Investment OptionRisk LevelExpected ReturnsLock-in PeriodTaxability of ReturnsELSSHigh12-15%3 YearsTaxed > ₹1.25LPPFZero7.1%15 YearsFully Tax-Free (EEE)NPSModerate9-12%Till Age 6060% Tax-FreeSSYZero8.2%~21 YearsFully Tax-Free (EEE)Tax FDZero6.5-7.5%5 YearsInterest Fully Taxable

Benefits & Challenges of 80C Investments

The Good Stuff (Benefits):

Financial Discipline: Mandatory lock-ins prevent “impulse buying” with your savings.

Wealth Compounding: Most 80C options are long-term, allowing your money to grow exponentially over 10-20 years.

Reduced Liability: It is the most direct way for a middle-class Indian to lower their tax bill significantly.

The Reality Check (Challenges):

Liquidity Crunch: If you have a sudden medical emergency, money in a PPF or SSY is very hard to access.

Market Volatility: Options like ELSS can go through “red” phases where your principal might dip.

Stagnant Cap: The ₹1.5 Lakh limit hasn’t been increased in over a decade, meaning it doesn’t quite keep up with the inflation of 2026.

Future Trends: Tax Saving in 2026 and Beyond

As we move through 2026, the government’s intent is clear: they are nudging everyone toward the New Tax Regime. The “simplification” of taxes usually means phasing out old-school deductions.

What to expect:

AI-Driven Planning: Expect more fintech apps that use AI to automatically rebalance your 80C portfolio based on market conditions.

Focus on NPS: The government wants to reduce its future pension burden, so expect more “bonus” deductions to be added exclusively to NPS.

Digital Verification: Gone are the days of manual receipts. In 2026, most of your 80C proofs are automatically fetched from your PAN-linked accounts into your ITR.

Conclusion: Your 2026 Game Plan

There is no “one size fits all” strategy for Section 80C.

If you are young and looking for growth, lean heavily on ELSS.

If you are approaching retirement, prioritize PPF and NPS.

If you have a young daughter, SSY is a non-negotiable win.

The smartest move? Diversify. Use a mix of market-linked and fixed-return instruments. Most importantly, don’t wait until March 31st! Start your SIPs or deposits now to avoid the last-minute stress. Your future self will thank you for the extra ₹45,000 in your pocket!

No Responses