Keeping up with the stock market is no simple task. It can be overwhelming as prices move every second, charts can be complicated, and news floods in nonstop. That’s why more investors are turning to AI stock tracking tools to help them automate analysis and generate insights in real time. If you’re a trader or long-term investor, AI investing tools allow you to bring structure to your decision-making.

Here’s a rundown of the best stock monitoring tools.

TrendSpider: Best for automated technical analysis

TrendSpider is an award-winning AI platform built to help traders uncover strategies, identify opportunities, analyze assets, and time trades faster. You can explore these strategies with over 50 years of historical data.

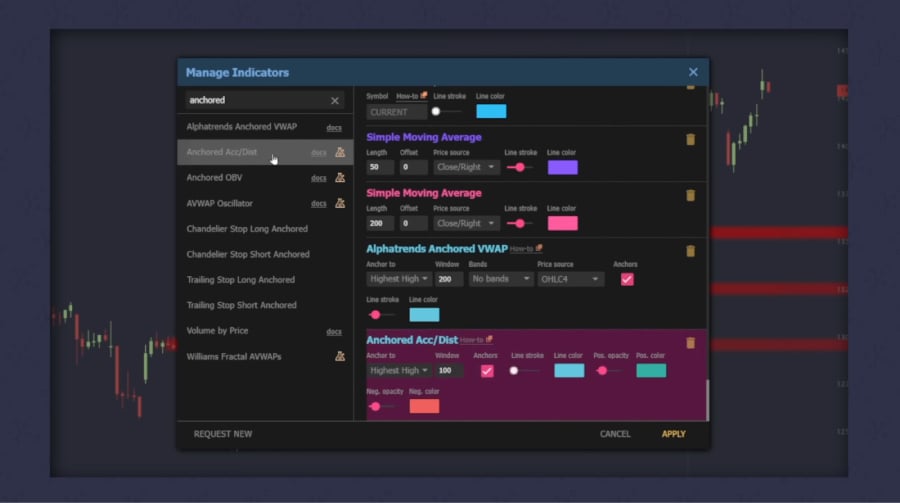

Plus, TrendSpider takes charting and analysis to the next level with its native automated pattern recognition, multi-timeframe analysis, and over 200 built-in indicators. It automatically detects chart patterns, trendlines, Fibonacci levels, and support and resistance zones. These features improve the precision of your analysis by minimizing human error and bias.

You can also check all your trading conditions automatically in real time with its smart checklists, and speed up your analysis with its custom rules and advanced filters.

Trade Ideas: Best for real-time signals and scanning

Trade Ideas is often ranked at the top of AI trading software lists for good reason. Its AI engine, Holly, is designed to provide real-time stock suggestions to premium subscribers, including entry and exit signals. It runs millions of backtests every night and produces daily watchlists and intraday signals, designed for active traders who need fast, reliable alerts.

Holly uses different methods based on specialized algorithms designed to identify patterns, unusual events, or specific market situations that have previously shown potential for generating profits from trading.

Here’s how it works: you can create dynamic watchlists that update in real time, set price alerts to trigger when key levels are reached, and receive instant notifications through the platform’s alert windows the moment a setup occurs. Using the Trade Ideas’ chart trading feature, you can enter or exit positions directly from the chart with predefined risk levels, and then you can test and refine your strategies before going live with the platform’s backtesting tool.

Tickeron: Best for AI-driven trade ideas and forecasting

Tickeron is an AI tool that provides accurate forecasts and price predictions. This AI tool takes a broader approach to stock tracking, offering AI pattern recognition, forecasting, and even AI-generated model portfolios.

Machine learning powers Tickeron to deliver real-time trading signals and portfolio insights, which are essential for both beginners and advanced traders. Its AI trading agents generate actionable signals across multiple timeframes, including 5-, 15-, and 60-minute timeframes, to help you act on intraday opportunities with precision.

Additionally, Tickeron’s AI signal agents provide simple copy trading signals for fixed trade amounts. Meanwhile, its AI virtual agent offers advanced customization and built-in risk management, so you can automate your personal strategies.

Beyond real-time trading, Tickeron’s AI models forecast price trends and pattern probabilities, giving you a statistical edge when planning entries and exits.

Bottom line: Navigate markets faster with AI

With plenty of AI stock tracking tools available, you can turn raw market data into real-time insights for smarter decision-making. These stock monitoring tools deliver instant trade signals, provide forecasting, and automate charting and pattern detection, allowing you to react to opportunities faster and refine your strategies with precision.

AI will continue to evolve, and stock tracking tools will further innovate, enabling traders of all levels to make smarter, faster, and more confident decisions.

The post Best AI Tools for Tracking Stocks appeared first on eWEEK.

No Responses