If you ever feel like your budgeting tasks never end, AI tools for personal finance can make them manageable. These tools simplify budgeting, monitor bill due dates and send advance reminders, and automate small savings so you build a cushion without thinking about it. You can also use AI to keep investment contributions on schedule, categorize transactions accurately, and surface spending patterns that aren’t obvious in monthly statements.

Here’s a quick rundown of the best personal finance AI tools.

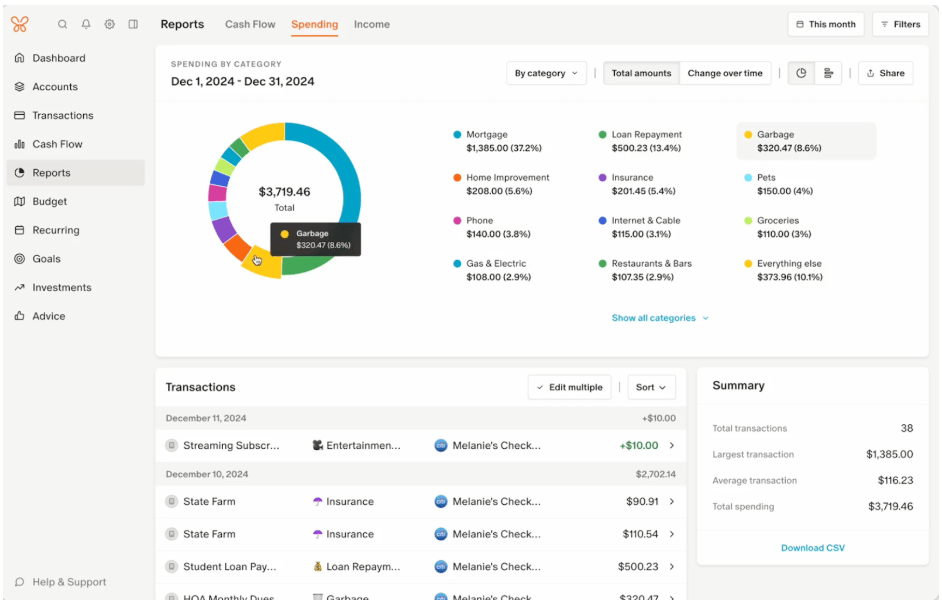

Monarch Money: Best for proactive budgeting and household visibility

Monarch Money is an AI finance tool that simplifies tracking expenses, budgeting, and planning in one platform. Monarch pulls in checking accounts, credit cards, loans, and investments, and then uses AI to clean up categories, surface spending patterns, and generate easy-to-understand summaries.

You can set monthly caps, build goal trackers, and share a single view with a partner to ensure budgets stay realistic. Forecasts and recurring-expense tracking help you plan cash flow before it becomes a problem, and custom rules keep categories tidy over time.

This personal finance AI tool starts at $14.99 per month and offers a seven-day free trial.

Rocket Money: Best for subscription cleanup and bill control

Rocket Money is an AI budgeting app that offers limited features to help you manage your personal finances at no cost. It scans transactions to find subscriptions, flags price hikes, and helps cancel services you don’t need. The app can negotiate lower rates for cable, internet, and phone, and it offers automated savings that move small amounts to a vault without breaking your budget. Alerts for due dates and low balances keep late fees in check, and the dashboard makes it obvious where money is leaking.

If you want to create unlimited budgets, automate your savings, and customize your budget categories, you can subscribe to Rocket Money’s Premium membership, which starts at about $6 per month.

Wealthfront: Best for automated investing with cash features

Wealthfront is one of the best personal finance AI tools when it comes to low-cost, passive portfolio management. It builds and maintains diversified ETF portfolios, rebalances automatically, and applies tax-loss harvesting in taxable accounts to improve after-tax results.

You can schedule transfers on payday, track goals, and park short-term cash in the same ecosystem for a higher yield while keeping funds accessible. The interface favors clarity over trading drama, which makes it easier to stick to your plan through market swings.

The advisory fee starts at 0.25% per year with a $500 minimum. Wealthfront does not offer a free trial.

Bottom line: Automate your finances with AI

Personal finance AI tools won’t negotiate your salary or erase debt overnight, but they will keep your budget accurate, move cash to savings on schedule, flag wasteful subscriptions, and invest consistently so that progress compounds.

If you’re new to using AI tools for personal finance management, start by identifying your biggest bottleneck and choosing a single tool that addresses your needs. Then, connect your accounts and set three metrics to review in 30 days, such as dollars saved, categories trimmed, and contributions automated.

Sign up for free plans or trials to experiment until you find the right AI tool, then let it automate your personal finances.

Bargain shoppers, check out some of my favorite free AI tools.

The post Best AI Tools for Personal Finance appeared first on eWEEK.

No Responses