The security landscape for financial institutions has changed dramatically in recent years. Banks and credit unions face an onslaught of attacks unlike anything security professionals have ever seen before. As 2025 progresses, these threats aren’t letting up – they’re getting worse, forcing financial organizations to completely rethink how they protect sensitive data.

What Financial CISOs Are Facing Today

Talk to any CISO at a bank today and you’ll hear the same concerns. Gone are the days of fighting individual hackers – now they’re up against sophisticated criminal enterprises and even nation-states with massive resources. Financial organizations are 300 times more likely to get attacked than businesses in other sectors. Three hundred times! With numbers like that, it’s no surprise security teams are overwhelmed.

The threat landscape has evolved dramatically over the past year and a half:

Ransomware Has Evolved into Something Worse

Remember ransomware that just locked your files? That seems almost quaint now. Today’s attacks steal your sensitive data first, encrypt your systems second, and then threaten to publish everything unless you pay up. Ransomware attacks have evolved toward double-extortion tactics.

According to industry analysts, financial institutions are increasingly targeted by these sophisticated approaches that combine data theft and encryption. Recent industry reports document multiple cases of financial institutions facing ransom demands after customer data was compromised.

Supply Chain Attacks Are Hitting Hard

Supply chain vulnerabilities continue to impact financial institutions. When critical financial service providers experience security incidents, the effects can cascade to hundreds of dependent banks and credit unions, disrupting customer access and operations for extended periods. The financial sector has seen several significant supply chain disruptions in recent years. This highlights the importance of third-party risk management as NIST continues to evolve its guidance in this area, while many financial institutions are still picking up the pieces from similar incidents.

Cloud Security Remains Problematic

The pandemic-driven rush to cloud services left security teams playing catch-up, and many still haven’t closed the gaps. According to Thales Group, 39% of financial businesses have experienced a breach, which is 10 percentage points lower than the average across all industries (49%). Security assessments routinely find unencrypted financial data floating around development environments and access permissions that would make any auditor scream. These are basic issues that shouldn’t happen in finance, but they do – constantly.

Even Small Banks Are Targeted by Nation-States

Nation-state attacks used to target only the biggest global banks, but that’s changed. FS-ISAC data shows a 63% increase in state-sponsored activity targeting financial institutions of all sizes. Regional banks now regularly face sophisticated campaigns that bear all the hallmarks of APT groups. What’s truly scary? Many of these attacks remain undetected for months.

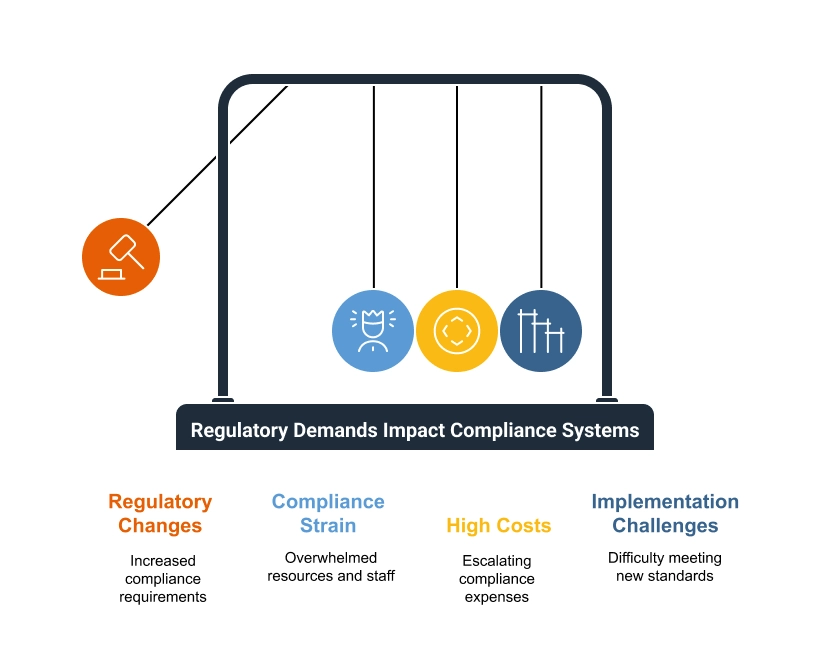

The Regulatory Burden Keeps Growing

While security teams battle these threats, the regulatory landscape has become incredibly demanding:

The SEC’s new cybersecurity rules require detailed incident disclosure within days – a timeline many compliance officers describe as “completely unrealistic” given their current capabilities.

NYDFS updated their Cybersecurity Regulation with requirements so granular and specific that many New York-based institutions are still struggling to implement them fully. Some smaller banks have had to hire dedicated staff just to handle the documentation requirements.

And for institutions operating across borders, the EU’s DORA requirements create massive compliance headaches. Many multinational banks struggle to harmonize their approach across different regulatory regimes, leading to astronomical compliance costs.

Why Traditional Security Just Doesn’t Cut It Anymore

Despite massive spending on cybersecurity tools, many financial institutions simply can’t keep up. Here’s why:

Tool Sprawl Is Out of Control

IBM research shows that organizations with more than 50 security tools performed worse at detecting attacks than those with fewer tools. Yet the typical financial institution uses 76 different security products. Some regional banks operate with over 80 separate security solutions. Their teams spend more time juggling tools than actually hunting for threats.

Alert Fatigue Is Real

Security analysts waste roughly 25% of their time chasing false positives, according to Ponemon Institute research. This happens everywhere – alerts get ignored because there are simply too many false alarms. Some mid-sized banks generate 10,000+ daily alerts with teams of just 3-4 analysts. You can’t investigate everything with those numbers, so real threats inevitably slip through.

Visibility Gaps Everywhere

With systems spread across on-premises infrastructure, multiple cloud providers, and third-party services, traditional security approaches create dangerous blind spots. Some financial institutions lack complete visibility into their cloud environments. Security teams often know everything about their on-premises networks but remain clueless about what’s happening in their cloud workloads.

Unlock full visibility into your security landscape:

Identify and classify assets

Detect hidden vulnerabilities

Fortify defenses

XDR: A Better Approach for Financial Services

This is where Extended Detection and Response (XDR) comes into play. And no, this isn’t just another buzzword or marketing gimmick – XDR represents a genuine shift in security strategy.

Here’s why XDR works better for financial institutions:

1. Finally, A Complete View of Your Environment

XDR provides that elusive single-pane-of-glass visibility across endpoints, networks, cloud systems, and applications. For banks running complex environments with legacy systems alongside public and private cloud services, this unified view makes all the difference. Security teams can track threats as they move between different parts of the infrastructure.

2. Smart Analysis Finds What You’re Missing

By analyzing data from multiple sources, XDR spots attack patterns that would remain invisible when examining individual security logs. This capability is crucial for catching the sophisticated multi-stage attacks financial institutions face daily.

3. Automated Response When It Matters Most

XDR enables automated response actions across security domains, helping teams contain threats quickly. In financial services, where every minute counts, this automation can prevent catastrophic breaches.

4. Making Security Teams More Productive

By providing a unified interface and consistent workflows, XDR helps stretched security teams work more efficiently. This operational improvement is critical given the persistent cybersecurity talent shortage plaguing the financial sector.

5. Better Regulatory Compliance Documentation

XDR’s comprehensive visibility and detailed audit capabilities make it easier for financial institutions to demonstrate compliance with regulatory requirements. The documentation of security controls and evidence of continuous monitoring helps satisfy many requirements from SEC, NYDFS, and other regulators.

Fidelis Elevate: An XDR Option Worth Considering

Several XDR solutions exist, but one true solution that works particularly well for financial institutions is Fidelis Elevate. Their “Active XDR” approach addresses several challenges specific to financial services.

Deep Environment Mapping

You can’t protect what you don’t know about. Fidelis Elevate provides detailed terrain mapping that aligns with NIST’s recommendation to “identify, prioritize, and focus resources on high-value assets that require increased protection.“

This capability helps banks and credit unions:

Discover and classify assets across on-premises and cloud environments Find shadow IT deployments that inevitably pop up in every organization Identify unmanaged BYOD and IoT devices that create security risks Focus protection efforts where they matter most

Deep Packet Inspection That Actually Works

Financial institutions process millions of transactions daily, making threat detection incredibly challenging. Fidelis uses Deep Session Inspection technology to examine traffic across all ports and protocols, finding advanced threats that other tools miss.

Their 20 GB 1U sensor can detect threats in nested files, encrypted traffic, and containerized workloads.

Connecting Weak Signals into Actionable Intelligence

Separating real threats from background noise remains one of the biggest challenges in financial security. Fidelis addresses this through Active Threat Detection, correlating seemingly minor signals into high-confidence detections based on the MITRE ATT&CK framework.

This approach creates detailed event timelines that help analysts understand potential compromises quickly.

Deception Technology That Catches Attackers

One of Fidelis Elevate’s most interesting features is its integrated deception technology. For financial institutions, this provides several advantages:

Creates confusion for attackers by deploying convincing decoys Enables early detection before production systems are compromised Provides valuable intelligence about attacker techniques Builds resilience by dynamically altering the environment

Works With Your Existing Security Stack

Financial institutions have already invested heavily in security technologies. Fidelis functions as an open platform that integrates with existing security infrastructure, including SOAR platforms, SIEM systems, threat intelligence feeds, and network security tools.

This integration approach lets banks enhance their security posture without abandoning existing investments.

Discover how Fidelis Elevate enables:

Real-time threat detection with DPI

Automated Response

Integrated deception technology

Building a Complete Financial Services Security Strategy

While implementing XDR provides a solid foundation, financial institutions need to incorporate this technology within a broader security strategy:

1. Risk-Based Security Is Essential

Develop a comprehensive risk management program that aligns security investments with business priorities. The FFIEC’s Cybersecurity Assessment Tool works well for financial institutions and provides a practical framework.

2. Layered Defenses Still Matter

Implement multiple security controls throughout your environment. Network segmentation, strong identity management, and data-centric protections create obstacles for attackers. If one control fails, others will still provide protection.

3. Financial-Specific Threat Intelligence Helps

Use industry-specific threat intelligence from sources like FS-ISAC to understand emerging threats and proactively adjust security controls. This intelligence helps prepare for attacks targeting financial institutions specifically.

4. Practice Your Incident Response Plan

Develop and regularly test comprehensive incident response capabilities. This includes coordination between security, IT, business units, legal, and communications teams. Tabletop exercises consistently reveal gaps that can be addressed before a real incident occurs.

5. Third-Party Risk Management Is Critical

Implement robust assessment procedures for vendor relationships. The OCC provides excellent guidance in this area.

The Path Forward

Let’s be real – financial institutions are fighting an uphill battle. The threats keep evolving, and honestly, there’s no silver bullet solution. But XDR technology gives banks and credit unions a fighting chance by providing what they’ve been missing: visibility, smart analytics, and automation when seconds count.

Security teams I’ve talked to who’ve implemented Fidelis Elevate alongside a solid overall security strategy tell me they’re finally able to sleep at night. They’re catching threats that previously flew under the radar for weeks or months. More importantly, they’re able to act before major damage occurs.

The future isn’t about perfect security – that’s a pipe dream. It’s about giving defenders the upper hand in an unfair fight. By combining XDR’s capabilities with risk-based approaches, layered defenses, and regular testing, financial institutions can build the resilience they need to protect what matters.

Bottom line: The banks that thrive in this environment won’t be the ones with the biggest security budgets, but the ones who approach security strategically and proactively. For those committed to staying ahead of evolving threats, XDR isn’t just another tool – it’s a fundamental shift in how we think about security.

Frequently Ask Questions

How does XDR handle legacy banking systems that can’t support modern security agents?

Modern XDR platforms can monitor legacy systems through network-based detection, API integrations, and agentless scanning techniques. While direct endpoint visibility may be limited for legacy systems, the network traffic and access patterns can still be monitored to detect suspicious activities.

What data privacy considerations should financial institutions address when implementing XDR?

Financial institutions must ensure their XDR implementation complies with regulations like GLBA, GDPR, and CCPA. This includes establishing data minimization practices, implementing appropriate access controls for sensitive data, and creating workflows that respect customer privacy while enabling security monitoring.

How do XDR solutions integrate with fraud detection systems common in financial services?

Leading XDR platforms offer API-based integrations with fraud detection systems to correlate security and fraud signals. This integration helps identify connections between cybersecurity incidents and fraudulent transactions, creating a more comprehensive defense against financial crimes.

The post Building a Strong Security Approach for Financial Institutions appeared first on Fidelis Security.

No Responses